does colorado have an estate or inheritance tax

Estate tax of 08. The good news is that since 1980.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Maryland is the only state to impose both.

. An estate tax is not the same as an inheritance tax. An inheritance tax is a. But that there are still complicated tax matters you must handle once an individual passes away.

But that there are still complicated tax matters you must handle once an individual passes away. When it comes to federal tax law unless an. A state inheritance tax was enacted in Colorado in 1927.

Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. However Colorado residents may have to face some fiscal burdens even if they inherit property within the state.

However Colorado residents still need to understand federal estate tax laws. Colorado estate tax replaced the inheritance tax for decedents who died on or after Jan. There is no estate or inheritance tax collected by the state.

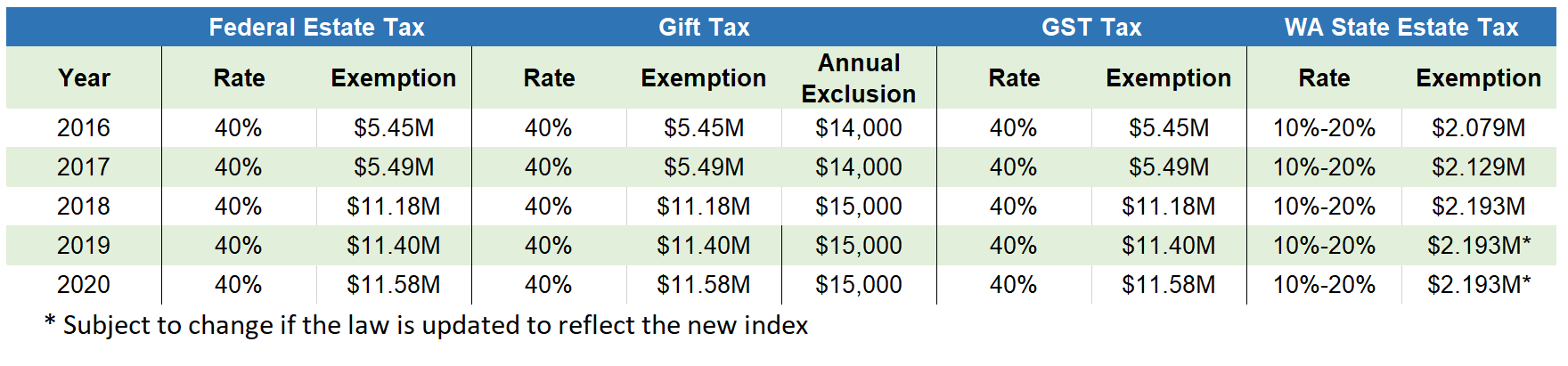

Colorado does not have an inheritance tax or estate tax. Estate tax estate tax is a tax on assets typically valued at the date of death. Estate tax of 10 percent to 20 percent on estates above 55 million.

There is no estate or inheritance tax collected by the state. A state inheritance tax was enacted in colorado in 1927. There is no inheritance tax or estate tax in Colorado.

There is no estate or inheritance tax collected by the state. Some states do assess inheritance tax if the decedent passes away in a specific state even if the. As a matter of fact you may have to.

However Colorado residents still need to understand federal estate tax laws. When it comes to. While many people confuse inheritance taxes and estate taxes theyre actually two slightly different things.

Hawaii and Washington State have the. There is no estate or inheritance tax collected by the state. Estate tax of 112 percent to 16 percent on estates above 4 million.

In fact only twelve states in the us. Does Co have a state estate tax. It happens if the inherited estate exceeds the Federal Estate Tax exemption.

As a matter of fact you may have to. When it comes to. Colorado Inheritance Tax and Gift Tax.

The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. What is Inheritance Tax IHT and do I have to pay it. However Colorado residents still need to understand federal estate tax laws.

No Colorado does not have an inheritance tax. That tax is levied after the money has passed on to the heirs of the recently deceased. 4 the federal government does not impose an inheritance tax.

Until 2005 a tax credit was allowed for federal estate. The state of Colorado. However Colorado residents still need to understand federal estate tax laws.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. The estate tax is different from the inheritance tax. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

There is no inheritance tax or estate tax in colorado. Tax Return DR 1210. In addition to having no estate tax Colorado also has no gift tax or inheritance tax.

In the case of inheritance taxes spouses children or siblings often have different exemptions which we list in detail in table 35 in the 2015 edition of our annual handbook Facts Figures. Does Co have a state estate tax. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

Marylandwhich also has an estate taximposes the lowest top rate at 10 percent.

The Difference Between An Estate Tax And An Inheritance Tax Ohall Kemper Law

Colorado State Tax Guide Kiplinger

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax Probate Advance

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

Here Are The States With No Estate Or Inheritance Taxes Gobankingrates

Preserving Your Wealth A Guide To Colorado Probate Estate Planning Jr L William Schmidt 9781883726904 Amazon Com Books

State Estate And Inheritance Taxes Itep

2020 Estate Planning Update Helsell Fetterman

Inheriting A House In Colorado Things To Know Beforehand

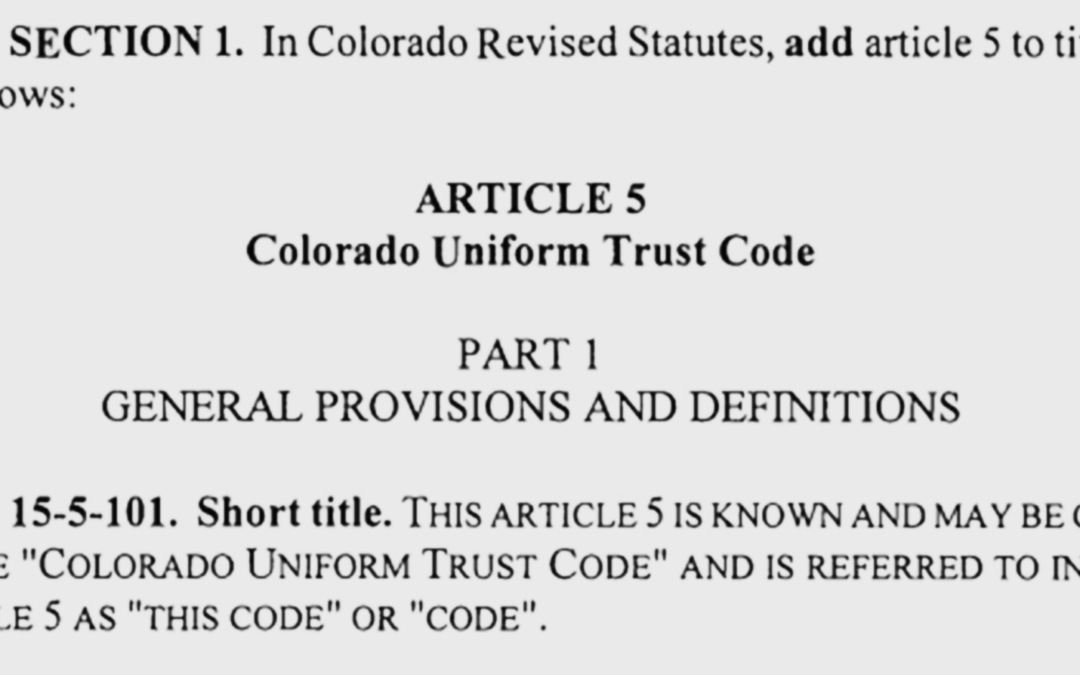

Big Changes Coming To Colorado Trust Law Evergreen Legacy Planning

States With No Estate Or Inheritance Taxes

Inheritance Tax Federal Heights Co

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Where Not To Die In 2022 The Greediest Death Tax States

How State Tax Law In California Affects Your Estate Planning